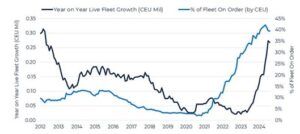

As the massive tariffs announced from US President Donald Trump came into force affecting US major trading partners, analysts see car carrier owners at most risk. As the next chart highlights, in 2024 the orderbook-to-fleet ratio reached the historical percentage of 34%. Considering the massive deliveries planned in 2025 and 2026, the car transportation business outlook for 2025 and the upcoming years was already quite uncertain and far from the after covid skyrocketing seafreights – mainly coming from the booming car exports from China to Europe and supported by the Red Sea crisis started in October 2023.

Source: VesselsValue

On the other side, we must take into consideration how important the US are for seaborne trade of vehicles. In 2024 the total vehicles entering US by sea reached a total of 4 million units, accounting for more than 25% of the global deepsea trade. According to the European thinktank Skandinaviska Enskilda Banken (SEB), a 25% decline of US imports as a consequence of tariffs would remove demand for about 40 pure-car-truck-carriers. In 2023, major shipowners ordered the staggering quantity of 80 new PCTCs. Therefore, the direct impact from tariffs would flood the market, with an additional 50%. Since Japan and South Korea combined account for 2.8 million cars, the car-mile impact should be even higher.

According to Veson Nautical, the global vehicle carrier market flipped from balanced to firmly negative for the rest of 2025, as experts now predict a supply growth of 10% and a car-mile demand expected to decrease by 5%. Biggest carmakers will switch to US production, in case they already have existing facilities that could be ramped up, such as Volkswagen or BMW, in order to avoid a significant decrease in market penetration in the US, with a negative impact on seaborne trade.

In a sign of companies front-loading shipments ahead of looming tariffs, car-carrying ships have sent more cargo to the United States in the first months of the year than 2024. According to data analytics firm Esgian, a total of 33 PCTCs left Europe for the US in February this year, up from 28 in February 2024. From Japan, China and Korea, the number of car-carrying ships leaving for the US in January rose from 69 to 77.

Following years of very limited investment, cash-rich ocean car carriers heavily invested on a fleet renewal campaign with the sector now having a heavy delivery schedule coming in the upcoming years. The significant increase of car-miles driven by Chinese exports boom and Red Sea crisis heavily supported the market, but the increasing trade tension imposed by the 2nd Trump mandate could represent the perfect black swan able to flip the market in a very short period of time. Will it be enough to capsize it?