The 2024 transit season on the Northern Sea Route (NSR) has reached unprecedented levels, confirming its status as an increasingly vital corridor for trade, particularly between Russia and China. According to the Centre for High North Logistics (CHNL), 97 transit voyages were completed, moving a total of 3.07 million tons of cargo across Arctic waters during the summer-autumn period. This marks a significant leap from previous years, signaling robust growth in the route’s usage and a deepening reliance on Arctic trade.

Source: Center for High North Logistics

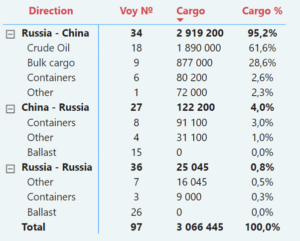

Of the 97 voyages recorded, 56 carried cargo while 41 were ballast trips—meaning vessels returned empty after delivering goods. The overwhelming majority of traffic, 95%, followed the Russia-to-China route, with shipments reaching 2.9 million tons. By contrast, the reverse flow from China to Russia accounted for just 120,000 tons, or 4%, reflecting a continued imbalance in the trade structure. A small portion—just 25,000 tons—represented domestic Russian shipments between Arctic ports.

The cargo composition reveals the economic priorities driving the NSR. Crude oil dominated transit traffic, with 1.89 million tons shipped to China, primarily from Russia’s northern ports like Murmansk and Primorsk. This oil trade is facilitated by specialized ice-class tankers designed to withstand Arctic conditions. Following crude oil, bulk cargo, including iron ore, coal, and fertilizers, comprised another significant share, reaching 877,000 tons. Additionally, containerized cargo—although modest in volume—added variety to the trade. Goods such as auto parts, construction materials, and consumer products flowed eastward to China, while lumber and pulp moved westward to Russia.

Source: Center for High North Logistics

The transit season remained highly concentrated in a narrow time window, from August to mid-October, when Arctic ice conditions are most favorable. Early August saw heavy ice, particularly in the East Siberian Sea, while moderate conditions in September provided sufficient navigability for increased activity.

Russia and China look at strategic Arctic future

This surge in NSR activity reflects the strengthening economic and strategic partnership between Russia and China, which has made the Arctic a focal point for both nations. Recent high-level talks between Russian and Chinese officials underscored their commitment to developing the NSR further. Russia is pushing efforts to enhance infrastructure, increase the fleet of nuclear-powered icebreakers, and modernize port facilities to support year-round operations. For Russia, the Arctic’s resources—particularly oil, gas, and minerals—represent a lifeline for economic growth, while the NSR itself serves as a conduit for reaching China’s vast market.

For China, the NSR is a critical element of its broader Polar Silk Road initiative, part of the Belt and Road framework. The route offers a shortcut between Asia and Europe, reducing shipping times by up to 40% compared to the Suez Canal. This efficiency translates to lower costs and faster delivery for key commodities, making it especially appealing for energy imports and industrial supplies.

Chinese shipping companies are already at the forefront of NSR activity. Notably, NewNew Shipping Line, operating from Yangpu Port in China, has dominated container traffic along the route. NewNew’s services link Chinese ports to Russian destinations, moving construction materials, machinery, and consumer goods eastward while shipping Russian timber and paper products westward. This activity highlights China’s increasing role as both an investor and operator in Arctic shipping.

Opportunities and challenges ahead

The record-breaking traffic in 2024 points to an evolving geopolitical and economic dynamic in the Arctic. Russia’s growing isolation from Western markets due to sanctions has accelerated its pivot to China, making Arctic trade a cornerstone of its export strategy. For China, meanwhile, the NSR offers an alternative to congested and geopolitically sensitive routes such as the Suez Canal, bolstering its trade resilience.

However, challenges remain. Ice conditions, while increasingly manageable with advanced technology, still limit the route’s seasonal viability. Furthermore, environmental concerns surrounding Arctic shipping—such as emissions, oil spills, and ecosystem disruption—pose long-term risks for development. International shipping activity beyond the Russia-China partnership remains absent, a reflection of geopolitical tensions and regulatory barriers.

Despite these challenges, the NSR’s performance in 2024 illustrates its growing importance as a bilateral trade corridor. The 45% year-on-year increase in transit cargo underscores Russia and China’s shared vision for the Arctic as a zone of economic opportunity. Investments in icebreaker fleets, port infrastructure, and shipping services are likely to further solidify this route’s role in global trade dynamics. Furthermore,

As both nations deepen their Arctic ambitions, the Northern Sea Route is emerging not just as an alternative trade corridor but as a symbol of a shifting global order—one where the Arctic plays a central role in connecting economies and shaping geopolitical alliances.

For detailed transit data and analysis, the Centre for High North Logistics remains a key source for monitoring developments along the NSR.

(Enrico Peschiera conducted this analysis. Thanks Enrico and Osservatorio Artico)

Article Source: https://chnl.no/news/main-results-of-nsr-transit-navigation-in-2024/