While the conflict between Israel and Iran is rapidly escalating and de-escalating on a daily basis, including also the pivotal role of the United States, major concern and fear among the investors caused oil futures to soar by around 10% and then, after Iran attacked US’ military bases in Qatar, bringing them down again with a sharp -6% decline. On Tuesday, oil prices tanked again with another -5% drop.

The main reason behind these very unusual ups and downs are related to the possibility of a Strait of Hormuz closure (or limitation) from Iran. The Strait, connecting the Persian Gulf with the Gulf of Oman and the Arabian Sea and flowing between Iran and UAE, is deep and wide enough to allow the world’s largest crude oil tankers’ transit.

Image 1: Location of the Strait of Hormuz

Source: BBC

But how important is the Strait of Hormuz actually for global energy security? And why is it considered a strategic chokepoint in international geopolitics?

In 2024, oil flow through the strait averaged 20 million barrels per day, or the equivalent of about 20% of global petroleum liquids consumption. An average of more than 3,000 vessels transits the Strait of Hormuz each month. At its narrowest, this crucial chokepoint is just 21 nautical miles wide.

As very few alternative options exist to move oil out of the strait in case of closure, and as the biggest oil producers/exporters heavily rely on it, the Strait of Hormuz is widely considered the world’s most important oil and natural gas chokepoint.

Some of the involved countries, mainly Saudi Arabia, UAE and Qatar, have few infrastructures in place that can allow them to bypass the Strait of Hormuz, but with no very significant effect, especially in the short run. On the other side, also Iran recently heavily invested in the construction of the Goreh-Jask pipeline and the Jask export terminal on the Gulf of Oman (avoiding the Strait of Hormuz). Nevertheless, the pipeline’s effective capacity (around 300,000 barrels per day) accounts only for 20% of the country current export capacity – and that’s why Iran is also considered as a potential loser in case of Strait closure.

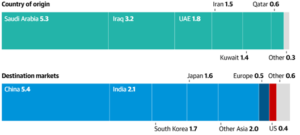

According to the main thinktanks, the 2nd Iran’s weak spot in case of a Strait closure is related to the main destination countries of Hormuz’s flows, as more than 80% of the crude oil and the LNG that moved through the Strait of Hormuz in 2024 went to Asian countries (mainly China, India and South Korea), followed by Europe and the United States (Chart 2).

Chart 2: Countries of origin and destination of crude oil flows through Hormuz, 2024.

Source: Guardian

In case of Strait closure China would be one of the most damaged countries. As the Asian country is still one of the few remaining commercial partners of Iran, damaging one of the closest (and unique) allies is not on top of Iran officials’ list.

As yet, the Strait of Hormuz is still open for business. Commercial traffic continues to flow both eastbound and westbound, but this could change very quickly. Investors are now betting on a “business as usual” Strait, as Iran responded to US’ bombers attacking the biggest American military facility in Qatar and Israel and Iran both agreed to a ceasefire. Nevertheless, the ups and downs during the recent days highlighted how important the Strait of Hormuz is for global trade, and Brent/WTI prices could be considered as the main market sentiment indicator of Israel-Iran-US relationship for the upcoming weeks.