As we are entering 2025, it’s a good opportunity to look back at the year that just passed.

Multiple challenges that affected maritime shipping in 2024 and will continue to do so in the new

year, such as decarbonization, digitalization, fleet renewal, management-labour relations and so

on, but if we were to single one out, it surely would be disruptions at key maritime chokepoints.

According to UNCTAD, the climate-induced droughts in Panama have reduced transits by almost

50% in the last 3 years, the new challenge of 2024 was the Red Sea crisis, reducing the transits

through the Suez Canal by more than 40% in 2024.

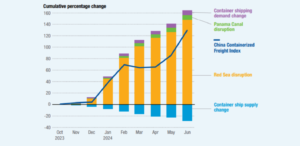

To understand the magnitude of these disruptions, it is essential to examine their direct impact on

container freight rates. The United Nation agency UNCTAD, in its annual publication, “Review of

the maritime transport” showed the following graph titled “China Containerized Freight Index:

Impact of Panama Canal and Red Sea disruptions”. It provides a crucial visual representation of

this impact, illustrating how these chokepoint issues affect the costs of global shipping. The

China Containerized Freight Index grew more than 120% from October 2023 to June 2024, due

to the following causes.

Red Sea Disruption

The Red Sea crisis has had the most substantial impact on freight rates. This crisis, caused

by Houthi attacks, forced vessels to divert around the Cape of Good Hope, leading to

significantly increased transit times and costs. According to UNCTAD’s analysis, the Red Sea

disruption contributed a staggering 148 percentage points to the cumulative increase of 120

per cent in the China Containerized Freight Index between October 2023 and June 2024. This

shows the immense pressure placed on shipping costs by the necessity of longer routes and

increased fuel consumption.

Panama Canal Disruption

While the Red Sea crisis takes centre stage, the graph also highlights the impact of disruptions in

the Panama Canal. Reduced water levels in the canal have limited daily ship transits, leading to

diversions and further pressure on global supply chains. Though less impactful than the Red Sea

issue, the Panama Canal disruption still contributed a noticeable 9 percentage points to the

Index.

Supply and Demand changes

The container ship supply capacity partially offset the impact of these disruptions. As vessels

were rerouted away from maritime chokepoints, the market responded by using available

capacity and newbuildings capacity to meet the increased demand. This increase in capacity

mitigated the rise in the Index by about 30%, showcasing the market’s ability to absorb some of

the demand increases.

In conclusion, the maritime shipping industry faces significant challenges as geopolitical

instability continues to disrupt key trade routes, driving up operational costs, and freight rates.

These increases, if sustained, could exacerbate inflation and hinder global economic growth.

Looking ahead, resilience and adaptability are crucial for the maritime industry. Stakeholders

must prioritize strategies to mitigate risks, optimize fleet management, and address the

cascading effects of geopolitical instability. Ensuring stability in global trade hinges on proactive

measures and collaborative efforts to navigate the uncertainties of 2025 and beyond.