After a period of sharp fluctuations caused by external factors such as drought, freight rate fluctuations and changes in demand for commodities e.g. liquefied natural gas, the Canal Authority continues to show strong financial strength. The short-term outlook (12–24 months) points to a gradual recovery in transits and sustained revenues, despite ongoing hydrological and competitive risks. In such scenario, the Panama Canal undoubtedly remains a strategic asset for global maritime trade.

Figure 1: Picture of Panama Canal crossing by M/V Evergreen Ever Meta taken during a cruise on M/V Grand Princess

When we talk about the Authority of Panama Canal, in acronym APC, we should keep in mind that it represents, without any doubt, the most important source of revenue for the Panamanian economy.

After all, being one of the four major chokepoints in global trades, together with Hormuz, Malacca and Suez-Bab el-Mandeb, involves owning one of the most influential and profitable assets in the world.

Indeed, the APC works as a motorway toll booth or as the ticket inspector onboard a bus/train; it means that every vessel or unit that transits through the Canal must pay a toll to the APC.

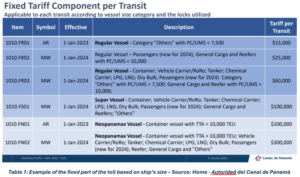

The “Tariff List” edited by APC is huge because is divided by many factors like ship type, tonnage, locks used, cargo capacity, cargo carried (deadweight) or TEU; the last one is clearly specific only for container vessels.

A “simplified” structure (fixed + variable) is often published to provide predictability for maritime operators; for example, you can have a fixed part, like the vessel size category (Regular, Super, Neopanamax), and then also a variable part based on the capacity of the vessel, which is different if we talk about crude oil tankers (metric tons MT) rather than container’s vessels (TEUs).

Hereunder there is an example of the Fixed component in the Tariff List based edited by APC:

Also, private boats pay tolls based on ship’s category and then on their LOA and again cruise/passengers’ ships pay tolls based on their category from dimensional point of view and then another part based on the total number of passengers carried onboard.

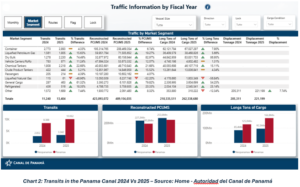

Thanks to a combination of positive external factors and the tariff system explained above, a highly favorable economic situation has been created for the APC. In fact, the Panama Canal closed fiscal year 2025 (FY2025) with outstanding results in transits and tonnage, reflecting the country’s ability to reliably and efficiently manage one of the world’s most important maritime routes and as a result contribute to the national economy also by enhancing and expanding the investments on the Canal which are set to begin in 2026.

As said by the APC, total revenues exceeded expectations reaching B/.5.705 million which is approximately 14.4% above the B/.4.986 million recorded in FY2024. Moreover, during FY2025, the Panama Canal achieved a net profit of B/.4.134 million, surpassing the budget projection by B/.372 million despite the challenges that arose from weather (high drought troubles) and market conditions. This result also represents an increase of B/.695 million compared to the net profit recorded in FY2024 when it reached B/.3.439 million (source: https://pancanal.com/en/panama-canal-maintains-operational-and-financial-strength/).

Also, in 2025 the Panama Canal registered a total of 13,404 transits, reflecting a 19.3% increase compared to the same period in 2024 when 11,240 transits were recorded. Of this total, 3,342 transits were Neopanamax vessels, while 10,062 were Panamax vessels million (source: https://pancanal.com/en/panama-canal-maintains-operational-and-financial-strength/).

Finally, APC’s 2025 management description note said that among the main drivers of growth were the container and liquefied petroleum gas (LPG) segments, which showed favorable performance throughout the year. Meanwhile, the bulk carrier segment continued its recovery process. The liquefied natural gas (LNG) segment posted results below expectations, mainly due to international freight market costs (source: https://pancanal.com/en/panama-canal-maintains-operational-and-financial-strength/).

Revenues also benefited from extraordinary factors such as frontloading (advance distribution), which contributed at least B/.100 million to FY2025 results, as well as the long-term slot allocation program (LoTSA), which helped partially offset the impact of reduced LNG vessel transits.

From a geopolitical point of view, on March 2025 one of the most important Hong Kong-based conglomerate, CK Hutchinson, well-established in maritime ports and global trades, has agreed to sell its controlling stake in the terminals near Panama to a consortium led by the US investment group BlackRock in partnership with the Swiss’ Terminal Investment Limited (TiL), MSC Group’s terminal operator.

The deal valued at nearly $23 billion is for 80 percent ownership of CK Hutchison’s portfolio of 43 global ports, spread in 23 countries, and in a parallel agreement for 90 percent ownership of Panama Ports Company, which operates the terminals in Balboa and Cristobal, close to the mouths of the Canal.

In this scenario US is acting a manoeuvre that could re-shape the geopolitical balance of global trades since the sale of licenses by CK Hutchinson will result in the US-Swiss’s Consortium gaining a 90% stake in Panama Ports Company and consequently in Panama Canal organization.

Once the deal will be completely finalized this could represent one of the most important acquisitions of the last year in the global trades and probably also BlackRock’s largest infrastructure investment to date, capable of boost Trump’s political approval ratings and ease Republican pressure on BlackRock and its CEO, Larry Fink.

The Panama Canal’s resurgence is not just a logistics story but a geopolitical and financial one. With container traffic at record highs in 2025, Suez in decline, and the ACP’s finances strengthened, nowadays the perfect moment has been created to invest in its ecosystem. For those willing to look beyond the headlines, Panama offers a rare blend of defensive infrastructure, growth catalysts, and strategic irreplaceability—a harbor in the storm of global trade’s next chapter.

Useful links:

Maritime Tariff List – Autoridad del Canal de Panamá

Maritime-tariffs-80-cancellation-oct25.pdf

Interim Financial Statements – Autoridad del Canal de Panamá