Last week liner giant Mediterranean Shipping Company (MSC) has launched an important cash tender for the acquisition of Gram Car Carriers (GCC), the world’s third-largest car carrier tonnage provider, with a premium stock price of 28.3%, representing a USD 700 million deal.

Gram Car Carriers owns and manages 18 car carrier vessels and manages 4 more units on behalf of third-party owners (Dual-Fuel LNG Car Carriers under construction), with a total capacity close to 100.000 CEU (car equivalent unit). 2023 operating revenue has reached a record high of USD 200.9 million reflecting higher average time charter rates compared to the prior year’s operating revenue of USD 121 million. Moreover, 2023 net income increased to USD 94 million compared with a profit of USD 23.9 million in 2022 (source: Gram Car CarriersAnnual report 2023).

The acceptance period will start at the latest on May 31 and remain open for no less than 20 days. The deal is expected to close during the third quarter of this year, but GCC board has unanimously recommended the shareholders to accept the MSC offer, which also already has two car carrier ships (capacity 6,700 car equivalent units each).

This deal is the latest in a series of major acquisitions by MSC, which is adding another important footstep in the maritime and logistics business, but what are the main reasons behind this important market decision for the Italian-Swiss liner?

The car carrier industry is facing a very positive market trend, especially thanks to important changes in the automotive industry.

As stated by the maritime thinktank Clarkson car carriers have been amongst shipping’s hottest sectors in recent years, especially the Pure Car Truck Carrier segment. Seaborne car trade has been on a remarkable run in recent years, rebounding by 38% across 2021-2023 after a 20% Covid-driven decline in 2020. 2023’s estimated deep sea trade total of 24.2m cars stood 15% above pre-covid levels, well ahead of total global seaborne trade more broadly (+2.3%).

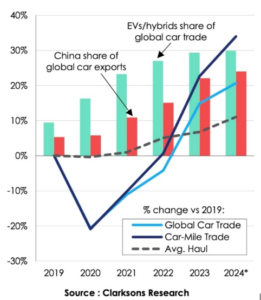

The next chart, issued by Clarkson in the Annual Car Carrier Trade & Transport 2023, underlines the main reasons behind the strong figures of recent years.

On demand side, strong export growth from Asia, including China (4.1m cars projected for 2023, up from <1m cars in 2020), Japan (up 17% to 5m cars) and South Korea (up 20% to 3.2m), to North America and Europe is pushing up average distances (up 7% since 2020).

At the same time, LMC Automotive estimates 2024 global light vehicles sales of 92.3 million units, implying 2.7% year-over-year (YoY) growth. Regarding 2025, LMC indicates another strong 4.5% growth.

On supply side, at 31 December the global car carrier fleet amounted to 766 vessels, according to Clarksons. In 2023, ordering activity for new car carriers remained at a high level due to the strong market. The total order book comprised 194 vessels with planned deliveries up until 2028. These will lead to a gradual increase in the PCTC fleet which is expected to be absorbed in the market over the coming years. At year-end, the PCTC fleet included 147 vessels older than 20 years and candidates for recycling. The global order book at the end of 2023 represented 37% of the current capacity.

Clarkson completes its report stating that while in the long run fleet growth is expected to pick up to 8% per year as the newbuild programme delivers and exceptional trade growth rates are likely to moderate as ‘pent up’ vehicle demand is worked through (watch for a ‘low case’, especially if macroeconomic conditions do not improve), the short term outlook for car carrier market conditions remains robust, and an eventual ‘normalisation’ of market conditions could well take time.

#MSC #Carrier #CarCarrier #Shipping #SlothSea