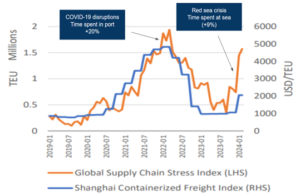

In the last years, we have witnessed record-breaking profits for container shipping largely due to the various supply chain disruptions experienced (COVID-19 pandemic, Panama Canal drought, Red Sea crisis). Although the correlation between supply chain disruptions and rate increases is obvious, it was never properly investigated by the private and public sectors. In 2021 the World Bank developed the Global Supply Chain Stress Index (GSCSI), based on AIS tracking data (Automatic Identification System). This index measures supply chain disruption comparing the Lead Time between subsequent port pairs with the median time. Although the index is said to be a port-centric indicator, it can also capture the delays accumulated in the sea passage. As this index is developed on AIS tracking data, it can be tailored to represent the supply chain stress for a determined region or single port. This highlights the visibility of bottlenecks and needs for investments.

Currently, other indexes try to capture supply chain disruption, most notably the Global Supply Chain Pressure Index (from the Federal Reserve Bank of New York) and Sea-Intelligence Vessel Schedule Reliability but, what is unique about the index developed by the World Bank is that it is a first attempt at decoding the correlation between disruption and freight rates. In its last working paper, the World Bank calculated that for every 1 Million TEUs interested coming under stress, spot rates would increase by around 2300 USD in the Shanghai Containerized Freight Index (SCFI).

Analysing the correlation between the disruptions and rates level it appears that the market operates under two different regimes depending on the situation:

- A low “normal”, when we experience overcapacity, rates tend to match the marginal cost, and carriers are lucky to “break even”. Price formation follows Bertrand’s price competition model.

- Stressed rate bursts, where shippers are competing for the remaining slots, and the rate formation follows the Willingness To Pay of shippers, according to Ramsey-Boiteux. The lower the price elasticity, the higher the markup Shippers are willing to pay to secure their goods on board. The price elasticity can vary depending on the cargo’s nature and its value.

The different regimes of price formation and these boom-bust cycles, typical of shipping, can be explained by different factors:

- Freight has low price elasticity, transportation costs represent a small share of landed price. Even at elevated rates, shippers are willing to pay premiums to expedite deliveries and cut lead times.

- Supply and demand have different adjusting speeds, demand can adjust more swiftly, compared to the slower supply. Vessels have long life spans and typically take 1-3 years to be delivered upon ordering. This requires carriers to carefully plan investments to avoid overcapacity but still be prepared to seize moments of rate increases.

In conclusion, this research from the World Bank is a good starting point for measuring supply chain stress, both at a global and local level, and correlating it to the impact on freight rates, and the recent increases in rates were due to the market mechanisms, and not necessarily signs of monopolistic behaviors.

#Container #Shipping #TEU #GlobalSupplyChain #AIS #SlothSea