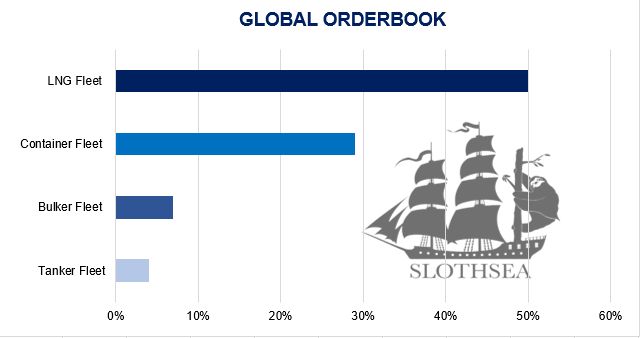

The global orderbook currently stands equivalent to a “moderate” 10% of fleet capacity, though varies significantly by sector, according to the latest data from Clarksons Research.

The increase in LNG ship orders, however, should not come as a surprise; in fact, the LNG market has taken advantage of several factors including certainly the Russian-Ukrainian conflict, implying that gas supply to the European continent is no longer via pipeline (Russia before the conflict was the main gas exporter to Europe with about 33% market share) but via maritime transport (USA and Qatar as main exporters).

Moreover, this situation, initially planned as a transitional solution, could become permanent as ships allow for “choice” of suppliers and greater adaptation to market needs.

This whole situation has brought extreme orders from LNG ship owners, making the price of LNG newbuildings reach an all-time high of US$259,500,000 for a standard ship.

However, because the cost of LNG newbuildings is not expected to fall in the coming months (as the first available slots in Korean shipyards are scheduled for the end of 2025), an initial reduction in orders has been occurring in recent weeks, also leading to a postponement in final investment decisions for projects.

The picture may change in the coming months especially in the tanker market, as recent analyses have shown a significant growth in freight rates due to an increase in trades in the Asian market; this will lead to more employment by tanker vessels (especially MR, LR 1/LR 2 and Aframax) and this could ensure an increase in the order book.

Data Source: Clarksons Research