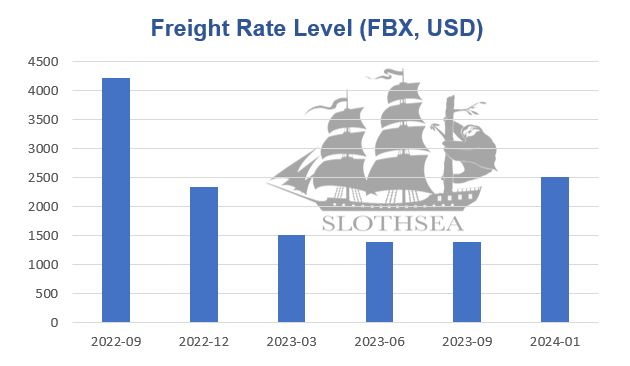

After a calm 2023, characterized by a low and static market from March till November, the new Red Sea crisis shocked the charts almost doubling the Freightos Baltic Index (FBX) in just one month, bringing it back to a level (2519$) which was not registered since December 2022.

This time however, such an increase is being cushioned by the concurrent rise of operational costs for liner companies. The alternative routing via Cape of Good Hope is impacting carriers’ strategies by being more demanding in terms of fuel consumption and vessels deployed to cover the usual rotations. Freights are back to end-of-2019 levels but costs are now way higher after 4 years of inflated prices, this means carriers might not end up with a consistent rise in profits, also depending on the duration and evolution of the current Middle-East Crisis.

25 days of the Suez Canal “closure” were enough to bring the container supply chain up again in the equation of the world economy. Yet, it is unfortunate how such a global and vital business needs to rely on macroeconomic misfortunes to earn breakeven revenues.