During this first half of June, we have witnessed a series of events capable of strongly influencing the oil market trend.

First and foremost, on Friday 13th of June Israel launched several waves of airstrikes against Iranian’s targets such as nuclear installations and refinery, ballistic-missile bases as well as military command-and-control centers. Following the attack, named “Rising Lion”, Israel stated that this was only the beginning of a military campaign aimed at preventing Iran from developing nuclear weapons.

Of course, all the above provoked an immediate response from the Islamic Republic which in turn started a series of guided bombardments, mostly using drones, to the damage of Israel.

Without analyzing the political and military implications of such actions we are more interested in the economic connotations, such the threats of closure of the Strait of Hormuz declared by Iran.

In fact, Iran is now threatening to close or at least disrupt shipping routes at this chokepoint through which around 20% of the world’s total oil supplies are shipped. In addition, they are so confident of US involvement that menace also attack against US military bases in that region or oil installations in the neighboring countries. All these measures carry significant risks because they are capable of entailing spikes in energy prices, which have already risen dangerously driven by conflict escalation between Iran and Israel.

Also, in relation to the Israel-Iran conflict, recent statements by the leader of the White House risk complicating the situation even further by leading to greater uncertainty in the oil markets and stronger oil prices surge.

Alongside the aforementioned conflict and possible related consequences there is a yesterday’s (17th of June) fresh news concerning a collision between two tankers near Khorfakkan anchorage in the Gulf of Oman, again in close proximity to the Strait of Hormuz. This area has become increasingly tense due to ongoing conflict between Iran and Israel, so a lot or vessel are now stucked there and problems are quickly spreading in one of the world’s busiest maritime routes. According to marine traffic service provided by VesselFinder, the VLCC Front Eagle, laden with crude oil, was heading towards Zhoushan, China, while the 23-year-old Suezmax Adalynn had just departed from anchorage in ballast when the collision took place. So again, another sign that shows the fragility of the oil market in the eyes of investors by contributing to higher prices.

In the framework already outlined it should also be remembered of the unstable condition that has existed since 2023 in the Red Sea. In this region, another political and armed movement namely the Houthis, aligned with Iran, have launched numerous missile and drone strikes on commercial and oil vessels in the Red Sea and Bab-el-Mandeb, reducing traffic by 70–90% in peak periods. All this has forced major shipping firms to reroute around the Cape of Good Hope, adding 10–14 days to voyages and significantly raising costs also the energy costs once the crude oil is purchased.

| Factor | Impact on Oil prices |

| Israel-Iran war | ~ 8-11% surge |

| Shipping disruptions (tankers collision) | ↑ Risk premium |

| Strait of Hormuz threat | Potential huge spike |

| Financial market drop | Reflects global risk (War-risk insurance ↑) |

Table 1: Summary of the causes which led to Oil Prices surge

In the immediate aftermath of the Israeli attacks, both oil prices and tanker rates moved up. This was to be expected and is a normal reaction to a spike in geopolitical tensions and an increased risk of significant disruptions to global energy supplies. Also, after U.S. President Donald Trump’s aggressive remarks toward Iran, oil prices spiked once again, reflecting investor anxiety about potential regional instability and global oil supply disruptions due to escalating tensions between Israel and Iran.

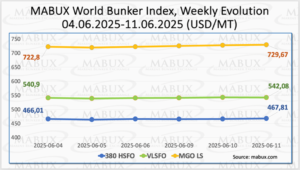

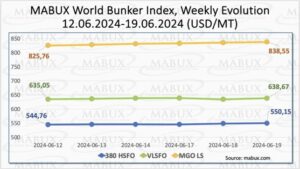

In particular, we deal with maritime oil price index, commonly referred to as the “bunker price index,” which tracks the cost of marine fuels used in shipping. These prices are crucial for ship operators, traders, and analysts to assess fuel expenses and market. One of the key bunker price indices is without any doubt the MABUX Global Bunker Index, which tracks three primary fuel types:

- 380 HSFO (High Sulphur Fuel Oil): A heavier, less refined fuel.

- VLSFO (Very Low Sulphur Fuel Oil): A cleaner alternative with lower sulfur content.

- MGO (Marine Gas Oil): A lighter, more refined fuel

Figure 1: MABUX Week 24 of 2025

Figure 2: MABUX Week 25 of 2025

As of mid-June 2025, global oil prices have been influenced by geopolitical tensions, particularly the Israel-Iran conflict. This has led to increased volatility in oil markets, affecting bunker fuel prices. For instance, rates for Very Large Crude Carriers (VLCCs) from the Middle East to China have surged by 40% since June 13, 2025, due to heightened risks in the Strait of Hormuz. This situation was again worsened by yesterday’s news of the collision between the two oil tankers in the Gulf of Oman. How the freight rates will go from here on it remains to be seen… stay tuned