Recent news of a potential return to the Suez Canal from the Danish carrier Maersk, reportedly starting in December, signalled a critical turning point for East-West liner shipping. The market was notably caught by surprise by the Suez Canal Authority’s announcement of a fixed December timeline, which effectively was immediately contradicted by Maersk with a more cautious stance that stressed security of crew members first. This discrepancy highlights the tension between the Egyptian Authority, urging to restore revenue, and carrier’s primary concern for crew and asset safety, keeping an eye on seafreights and profitability at the same time. This strategic re-entry, following the costly detour around the Cape of Good Hope caused by the Red Sea Crisis, can financially reshape the global container supply-demand balance.

For ocean carriers, crossing again the Suez Canal eliminates the costly 10-14 day operational delay and the associated higher fuel consumption of the Cape of Good Hope route. In addition, the Suez Canal Authority is offering a package of flexible pricing policies that includes a 15 percent discount on transit tolls for containerships exceeding 130,000 tons to secure the flow of traffic and revenue.

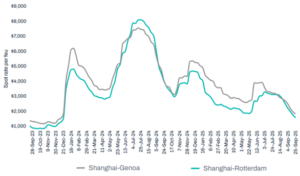

On the other side, the most significant financial and market-altering impact of the Suez re-entry that is slowing down ocean liners to switch is the potential compression of container freight rates due to a structural market shock. The long Cape of Good Hope detours previously acted as an artificial constraint on global shipping capacity. Reverting to the shorter Suez route is projected to immediately release between 6.5% and 12% of global container fleet capacity back onto the market. This massive infusion of effective capacit, occurring concurrently with the ongoing delivery of new mega-vessels from Asian shipyard, is forecasted to put severe and sustained downward pressure on spot freight rates, signaling the end of the already fragile high-rate environment. Analysts, specifically those at Lloyd’s List and Sea-Intelligence, predict that this excess capacity could trigger a massive drop in container rates from their crisis-level peaks. This decline is expected to push rates on the Asia-Europe trade lane back toward sub-economic levels below $1,000 per 40ft.

Chart 1: Drewry Weekly WCI

Source: Drewry

In addition, the synchronized resumption of transits by major carriers will also introduce the immediate operational challenge of Network Shock and Port Congestion: the rapid return compresses transit times, meaning vessels that were spread out by the long Cape of Good Hope route will suddenly arrive in European and Asian terminals in quick succession. This phenomenon, known as ‘network shock’, would create a major short-term risk of port congestion and operational delays at destination hubs. For shippers, this overall shift translates to a welcome and immediate relief in logistics costs, but for carriers, this sudden evaporation of the revenue windfall gained during the crisis presents a substantial challenge to profitability and future investment planning. Ultimately, while commercial discounts and operational savings are achieved immediately, the move fundamentally exacerbates a structural supply-demand imbalance in the container market, driving freight rates steeply downward.

The long-term sustainability of this transit, avoiding future costly re-routing, managing congestion, and preventing a full-scale rate war, is entirely conditional on the permanent establishment of reliable security guarantees in the Red Sea corridor. Nevertheless, the potential impact on seafreights is pushing carriers to a more conservative approach that is allowing them to keep rates above a profitability level that would be immediately jeopardized with a Suez Canal re-routing.