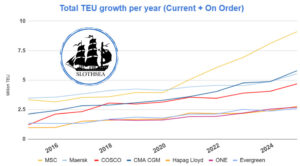

Race for Scale vs. Pursuit of Profit

A review of the container market’s last decade reveals two divergent strategies: one carrier’s unmatched pursuit of scale, and a separate battle for efficiency.

MSC’s Dominance in Growth: The data from 2015-2025 is unambiguous. MSC is in a league of its own. With a projected average growth of 10.98%, its fleet expansion has created a massive gap, separating it from all competitors in a relentless pursuit of volume and market share.

Below MSC, the carriers have split into two clusters:

- The Chasers: CMA CGM and COSCO show aggressive growth, trying to keep pace.

- The Mid-Pack: Hapag Lloyd, ONE, and Evergreen form a tighter group with more moderate expansion.

Maersk’s Pivot and the Profitability Question: The outlier in the growth story is Maersk. With the lowest average growth (4.85%), Maersk clearly pivoted away from the volume race, suggesting a focus on operational excellence and profitability.

However, the profitability reveals who is winning in the efficiency battle.

According to profitability data (total net profit after tax %) Maersk and CMA CGM leverage their scale to generate the highest net profit.

However, the two giants are not the most efficient. Despite their smaller fleets, Evergreen and HMM seem to achieve higher net profit margins % (20-30%), demonstrating a powerful ability to control costs and maximize profitability per container.