A few hours later the ceasefire agreement between Israel and Hamas came into effect last Sunday, the leader of Yemen’s Houthis said that as long as the ceasefire remains in place, international merchant ships may now transit the Red Sea

According to the biggest ocean liners, who started sailing via the Cape of Good Hope instead of crossing the Suez Canal since the end of 2023, matters will inevitably take longer to return to normal operations, keeping well in mind that the Houthis in Yemen have delivered the most profitable year in the history of liner shipping aside from the post-Covid era.

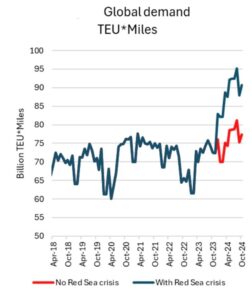

Indeed, the European thinktank Sea-Intelligence states that TEU-miles on the headhaul trades between global region increased by 32% compared to previous year.

As a consequence of that, rapid increase in profits has severely impacted newbuild orders, since shipowners have added more than 3.5m TEU in new orders in 2024 (the second highest number ever) and the orderbook to fleet ratio is now close to 26%.

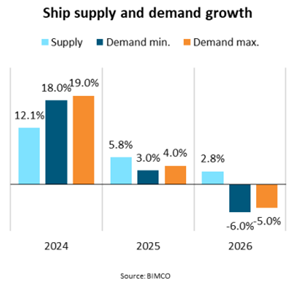

BIMCO, in its December 2024 “Container Shipping Market Overview & Outlook”, stresses out that the recent surge in the global orderbook is going to impact ship supply in the next few years, as it estimates that while cargo volumes is expected increase global demand by 22% between 2019 and 2026, the total fleet growth is expected to climb by a staggering 46% compared to 2019.

Should ships be able to cross the Suez Canal again throughout 2025 or 2026, BIMCO forecasts that global demand will fall 5-6% on a yearly basis. On the other side, by the end of 2026, another 2.6m TEU are forecast to be added, equal to a combined 8.5% expansion during 2025 and 2026. Liners are expected to partially offset the imbalance decreasing sailing speeds, but as the next chart shows, this is going to be less than enough as the combination of higher supply and lower demand that is going to take place after the Red Sea crisis ends will play a key role on global figures.

The rapid supply/demand imbalance caused by the reopening of the Suez Canal route is therefore going to significantly impact freight rates, expected to fall way below 2019 levels.

While the unexpected Red Sea crisis has positively impacted ocean liners’ P&L in 2024 (and this is going to last for several months in 2025), the impact of a significant surge in orders and deliveries on freight levels should be expected, and that’s why even BIMCO points out to be taken by surprise by the rapid orderbook increase of 2024, which made the already unstable situation even more uncertain.