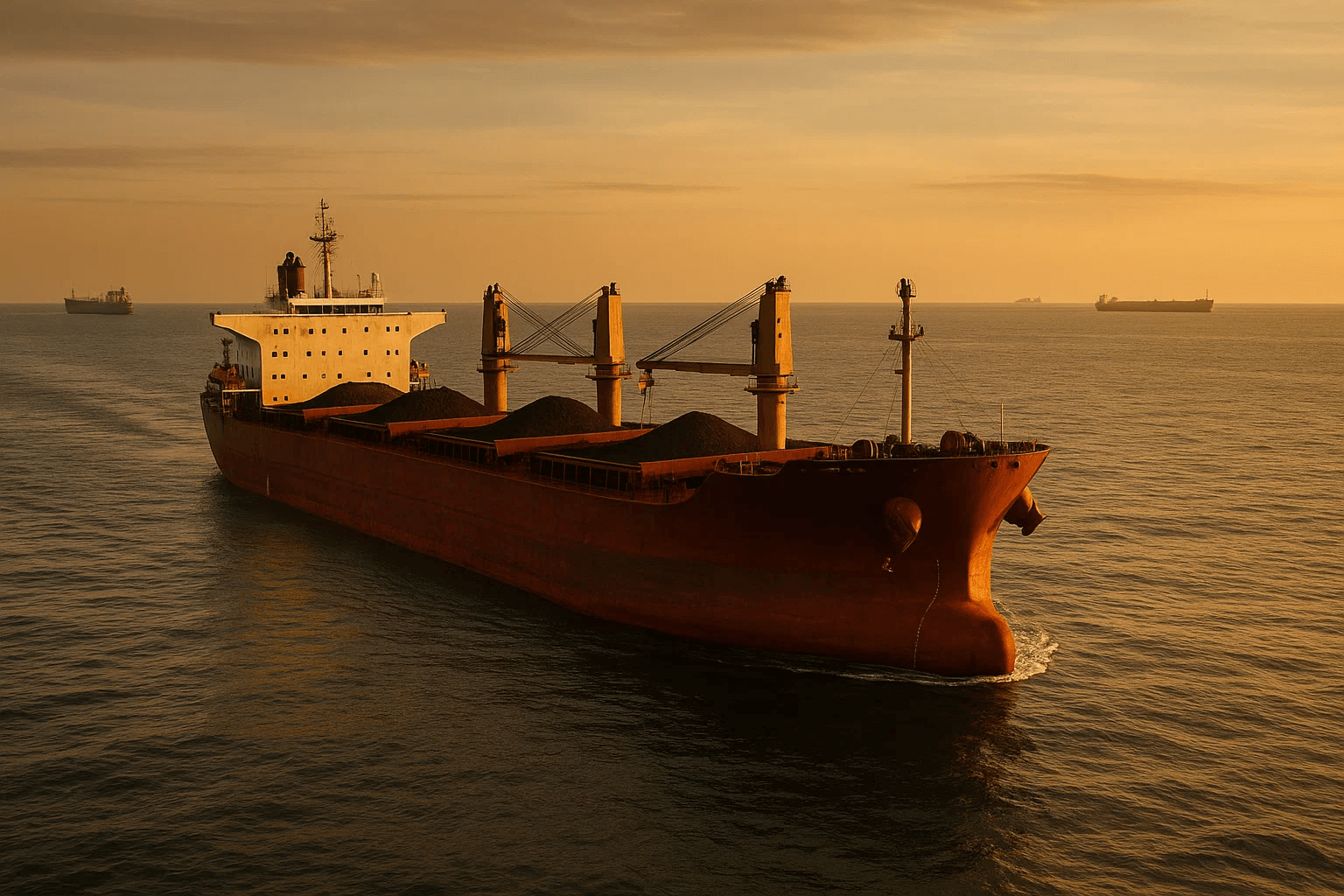

The dry bulk market is bracing for a turbulent 2025, with Baltic indexes slipping to year lows. After a strong 2024, asset prices are now expected to decline as second-hand ship values and freight rates weaken. Despite robust activity in Chinese shipyards, newbuild prices could stagnate without a surge in contracting, which seems unlikely.

Meanwhile, recycling prices are under pressure from abundant low-cost Chinese steel exports, further dampening market prospects. Insiders predict a “dull” year ahead, characterized by weak freight rates, declining asset values, and limited activity. Whether this is a passing slump or a harbinger of deeper issues remains to be seen, as the sector navigates uncertain waters.

- Post-COVID Recovery Phase

By 2025, the global economy may have already adjusted to the post-pandemic environment, which could result in a more stable, less volatile economic growth trajectory. The sharp recovery seen in earlier years (e.g., 2021-2023) could give way to a more mature and steady phase of global trade. With less rapid economic shifts, the demand for dry bulk shipping might stabilize, leading to less excitement in the market.

- Environmental Regulations Impacting Fleet Expansion

As environmental regulations around shipping tighten (e.g., IMO 2030 and 2050 targets for carbon reduction), shipping companies are expected to shift their focus from expansion to compliance. This could limit fleet growth or modern fleet turnover. With stricter emissions standards and higher costs for retrofitting older ships, the supply side of the market might stagnate, resulting in a lack of substantial market developments that typically fuel volatility.

- Slowing Chinese Demand

China is the world’s largest importer of dry bulk commodities, particularly iron ore and coal. However, by 2025, the country could face structural slowdowns due to demographic challenges, shifting industrial strategies, or a decline in heavy manufacturing. If China’s demand for bulk commodities plateaus or grows at a slower rate, this would contribute to weaker trade volumes in the dry bulk market.

- Global Supply Chain Normalization

The post-pandemic disruptions to global supply chains could have settled by 2025, leading to more predictable patterns of trade and reduced urgency or strain on the shipping market. For example, congestion at ports and shipping delays, which were major drivers of market volatility in recent years, may diminish as logistical networks become more efficient. This could result in a less eventful period for dry bulk shipping.

- Overcapacity and Slow Market Recovery

The dry bulk fleet might see overcapacity by 2025, particularly if the delivery of new vessels that were ordered during periods of market optimism leads to an excess supply of shipping capacity. A sluggish recovery of global demand for bulk commodities, combined with an oversupply of ships, could depress freight rates and reduce the overall trading activity, leading to a less dynamic market in that year.

As we peer into the horizon of 2025, one thing is clear: predictions can only take us so far. Markets have a funny way of defying expectations, and what seems like a “dull” year today could take an unexpected turn tomorrow. So, buckle up and keep an eye on the tide—because only time will reveal what’s truly in store for the dry bulk shipping world.