The ongoing Russia-Ukraine war has had a profound impact on dry bulk markets, upending trade routes and increasing operational costs for market participants. Since the onset of the conflict, insurers have hiked premiums, trade flows have been redirected, and a complex web of sanctions has formed, reshaping the market landscape. Grain and coal shipments, both critical to the dry bulk sector, have faced particular strain. In the early days of the war, the blockade of Ukrainian ports disrupted global wheat and corn supplies, driving prices up by 25% and 15% month-on-month, respectively—a spike partly alleviated by the UN’s Black Sea Grain Initiative.

To navigate Russian threats, Ukraine has continued shipping dry bulk commodities through the Bosporus Strait, with volumes moving via Romanian and Bulgarian waters, both NATO member states. This route offers an added layer of protection against Russian attacks. As a major grain supplier contributing over 6% to global trade, Ukraine’s ability to sustain these exports has been pivotal, helping push the FAO’s cereal price index down by 15% year-over-year.

Yet recent missile strikes have cast a shadow over this vital corridor. Since October 5, 2024, four vessels in Ukrainian ports or waters have been targeted by Russian missiles, according to UK Defence Intelligence. This follows a wave of September attacks, the first since November 2023. If such incidents persist, the implications for dry bulk markets could be considerable.

Despite disruptions, Ukraine’s dry bulk exports have demonstrated some resilience. During the first ten months of 2024, shipments rose 3% compared to last year’s period, with iron ore volumes up by 2% and grain by 6%. Nevertheless, total exports remain 41% below 2019 pre-war levels, underscoring the ongoing challenges.

Global reliance on Ukrainian exports has gradually declined. In 2019, Ukraine accounted for 10% of global grain and oilseed exports; by 2024, this figure has dropped to 6%. Meanwhile, Brazil—another key exporter of corn and soybeans—has stepped up, increasing its share from 23% in 2019 to 27% in 2024, filling part of the void left by Ukraine.

A potential escalation in attacks could disrupt Ukraine’s exports, which make up around 1% of the global dry bulk trade. This poses a particular risk for major importers like Spain and the EU, as well as China, which import 16% and 13% of Ukraine’s dry bulk exports, respectively.

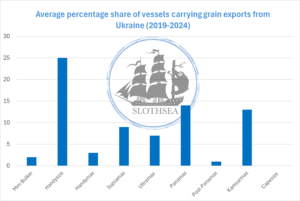

Segments most exposed to Ukrainian cargo flows are Panamax and Handysize vessels, which together transport about 40% of Ukraine’s dry bulk exports. Kamsarmax vessels, traditionally responsible for around 14% of Ukraine’s grain exports, and Supramax/Ultramax tonnage, carrying an additional 15%, are also impacted.

In particular, the P2A, P3A, and HS1 trade routes are at high risk, as Ukrainian volumes have been a key driver of gains on these routes, boosting earnings by 16%, 29%, and 2%, respectively, year-to-date. Should war-risk insurance costs make the Bosporus Strait economically unfeasible, fewer vessels may be able to sustain this route. Alternatively, an increase in Brazilian grain exports to Europe could offset some of the shortfall, with a positive knock-on effect on dry bulk tonne-miles.

Ukrainian exports have been one of the mainstays in dry bulk market resilience through 2024. Although shipments have not fully recovered to pre-war levels, they have shown relative strength amid widespread geopolitical uncertainty. In a world where disruptions are the new normal, the dry bulk market—and the global community—are watching closely, hoping Ukrainian exports will continue to endure through the latest phase of this crisis.