In the last few years we experienced an oversupply’s period which affected maritime trades, especially in the containerized market. Indeed Covid-19 crisis brought to an increasing in maritime trades and freight rates but after this disruption we accomplished a phase in the shipping cycle featured by a downturn of the freight rates caused, among other factors, by a strong oversupply.

However in 2024 this sequence of circumstances seems to have snapped since the global newbuilding orderbook is now facing a strong redemption. This achievement is the result of several reasons, such as:

- a surge in the global volumes carried by sea caused by a strong market activity in many production areas and also boosted by the low rates gathered until the beginning of 2024;

- the growing sustainability’s trend which cause a call for new vessels aligned with the most binding standards in order to reduce as much as possible the external costs;

- challenging climate changes like the drought in Panama’s Canal and lower water’s level in river connections which force the carriers to look at different routes almost always longer and more expensive. In such cases having bigger and most cutting-edge vessels helps to curb the rising costs and establishing, instead, benefits from economies of scale.

- supply chain pressures as a result of conflicts or piracy activity which, again, push the carriers on route diversions and led to decisions capable of establish economies of scale by using larger and newer vessels.

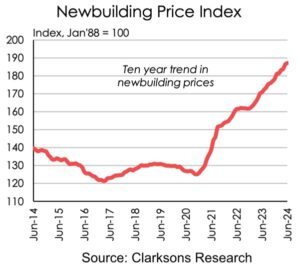

Then we start to understand the reasons why newbuildings orderbooks are growing back again, despite rising prices on materials and activities supplied by the shipyards, as reported in the graph below. In fact, during the last ten years newbuilding’s prices boosted a lot, especially from 2020 until 2024, almost reaching the peak experienced during 2008.

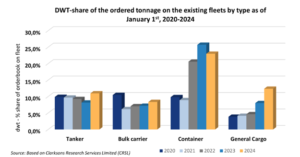

Just to better explain this growth in newbuilding orderbook we can have a look to the following graph which shows that 2024 on January 1st is already the strongest year by orderbook to the shipyards for almost every kind of vessel.

We must also specify that during 2024 container vessel’s request for newbuilding is growing steadily with all the majors players signing for new orders, like Maersk which signed firm shipbuilding contracts for six LNG dual-fuel boxships at Hanwha Ocean (according to Hanwha Ocean statements). Also CMA-CGM is reported to have signed an order of up to 18 containership newbuildings from Samsung Heavy (accordingly to Samsung Heavy Industries declarations) and Evergreen Marine Corporation is said to have added, to a previous order of eight, other four 16,000 teu containerships at Japan’s Nihon Shipyard.

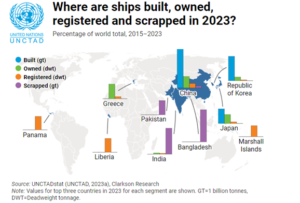

Finally, let’s end with a brief overview about the major shipyards worldwide. According to UNCTAD’s report in 2023 only three countries worldwide, i.e. China, the Republic of Korea and Japan, are the main shipbuilding hubs, accounting for 93% of the world’s total tonnage delivered. In addition, the U.S. Congressional analysis states that the nine largest shipyards split between China, Korea and Japan account for 75% of the world’s shipbuilding capacity. Only to mention some names of these giants in world shipbuilding we should keep in mind that Korean and Japanese shipbuilders are traditionally part of large manufacturing and financial conglomerates (e.g., Samsung Heavy Industries, Hyundai and Daewoo in South Korea, Mitsubishi Heavy Industries and Kawasaki in Japan), where other profitable segments can help weather the poor profitability of their shipbuilding sector, which often operate at a loss. Also chinese’s shipbuilders are now collaborating since the main two state-owned shipbuilding companies, CSIC and CSSC, were officially merged on November 26th, 2019, creating the largest shipbuilder in the world: China Shipbuilding Group.

Now the question is: “Will this pattern also lead the Q4 of 2024 and the coming years?”